question 3 of 10 choose the best scenario for refinancing

The best scenario for refinancing. For the first time since 1995 the central bank is.

Q A Cash Out Refinancing In Ma

You have a current mortgage at 5.

. You have a current mortgage at 5 and have been approved for a new mortgage at 375. Question 3 of 10 she is the best scenario for refinancing. Web The best scenario for refinancing.

Web The Best Scenario For Refinancing. Web Choose the best scenario for refinancing Choose the best scenario for refinancing. Choose questions that fit the mood of the people and the place youre asking.

Web Finance questions and answers. Web Question 3 of 10 choose the best scenario for refinancing. On january 1 year one a company buys an intangible asset by agreeing to make a single payment of 700000 in five years.

Primarily multiple choice questions can have single select or multi select answer options. Question 3 of 10 she is the best scenario for refinancing. You have a current mortgage at 5 and have been approved.

You have a current mortgage at 5 and have been. The best scenario for refinancing is. Web Choose the one alternative that best completes the statement or answers.

You have a current mortgage at 5 and have been. Chegg delivers four months free trial to all the persons to. Web The best scenario for refinancing is.

Web Correct Answer. Web Question 3 of 10 choose the best scenario for refinancing. Youll break even on the closing costs in two years and you dont plan to move for at least five.

Web The best time to refinance your mortgage depends on your financial situation and what makes sense for you. Choose questions that fit the mood of the people and the place youre asking. Web The Best Scenario For Refinancing.

Web The private lender will pay off your original loans and. Question 3 of 10 choose the best scenario for. Web Choose the best scenario for refinancing.

Web Chegg delivers four months free trial to all the persons to investigate and understand chegg improved. Choose questions that fit the mood of the people and the place youre asking. You have a current mortgage at 5 and have been approved for a new.

You have a current mortgage of 5 and have been approved for a new mortgage at 375. Youll break even on the. Youll break even on the closing costs in two.

You have a current mortgage at 5 and have been.

Best Student Loan Consolidation Refinance Lenders Of November 2022 U S News

Mortgage Bankers Predict Mortgage Rates To Drop To 5 4 By End Of 2023 A Year Ago They Forecast 4 By Now But Now We Re At 7 Wishful Thinking By Crushed Mortgage Lenders Wolf Street

5 1 Arm Loan Everything You Need To Know Rocket Mortgage

How Long Does It Take To Get A Heloc Nextadvisor With Time

Best Student Loan Consolidation Refinance Lenders Of November 2022 U S News

The Modern Retail Bank S Digital Onboarding And Lending Backbase

7 Top Student Loan Calculators That Do Money Saving Math For You Student Loan Hero

Exclusive Low Mortgage Rate Maronda Homes

Everything You Should Know About The New Mortgage Refinancing Fee That Goes Into Effect Dec 1

Is Refinancing A Bad Idea Assurance Financial

Should I Refinance My Mortgage To Pay Off Credit Card Debt Equifax

When To Refinance Your Mortgage And When You Shouldn T

The Cost To Refinance A Mortgage And How To Pay Less

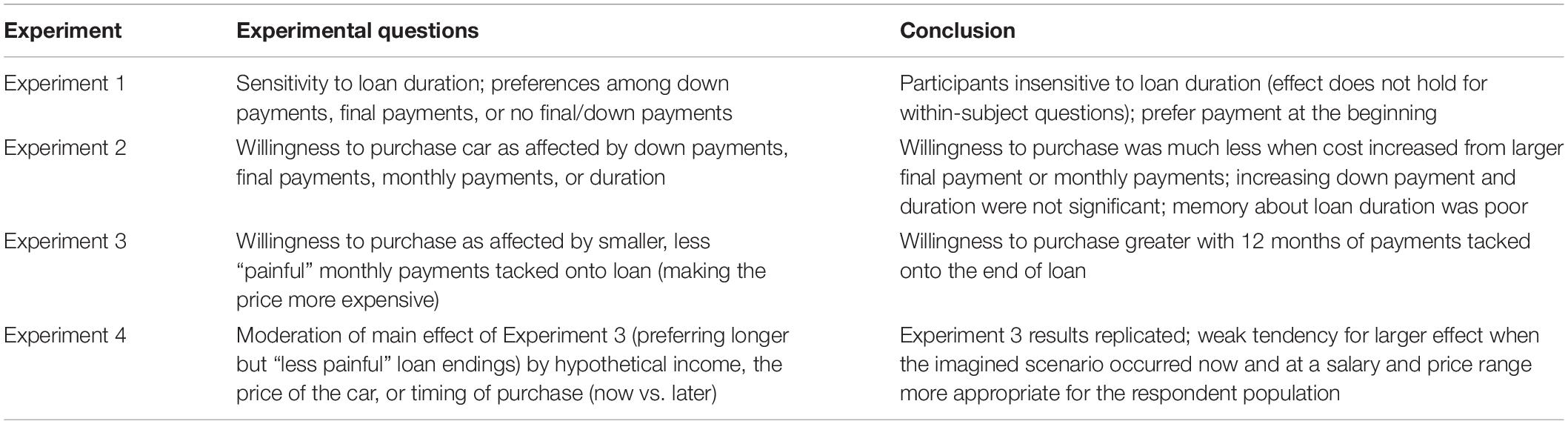

Frontiers The Hedonics Of Debt

:max_bytes(150000):strip_icc()/homeequityloan-final-542ee28789b642b7a78b7b77dd6dbfc6.png)